Investor relations

Disruptive innovation is our heartbeat. We're committed to pushing technology and challenging the status quo to empower human collaboration.

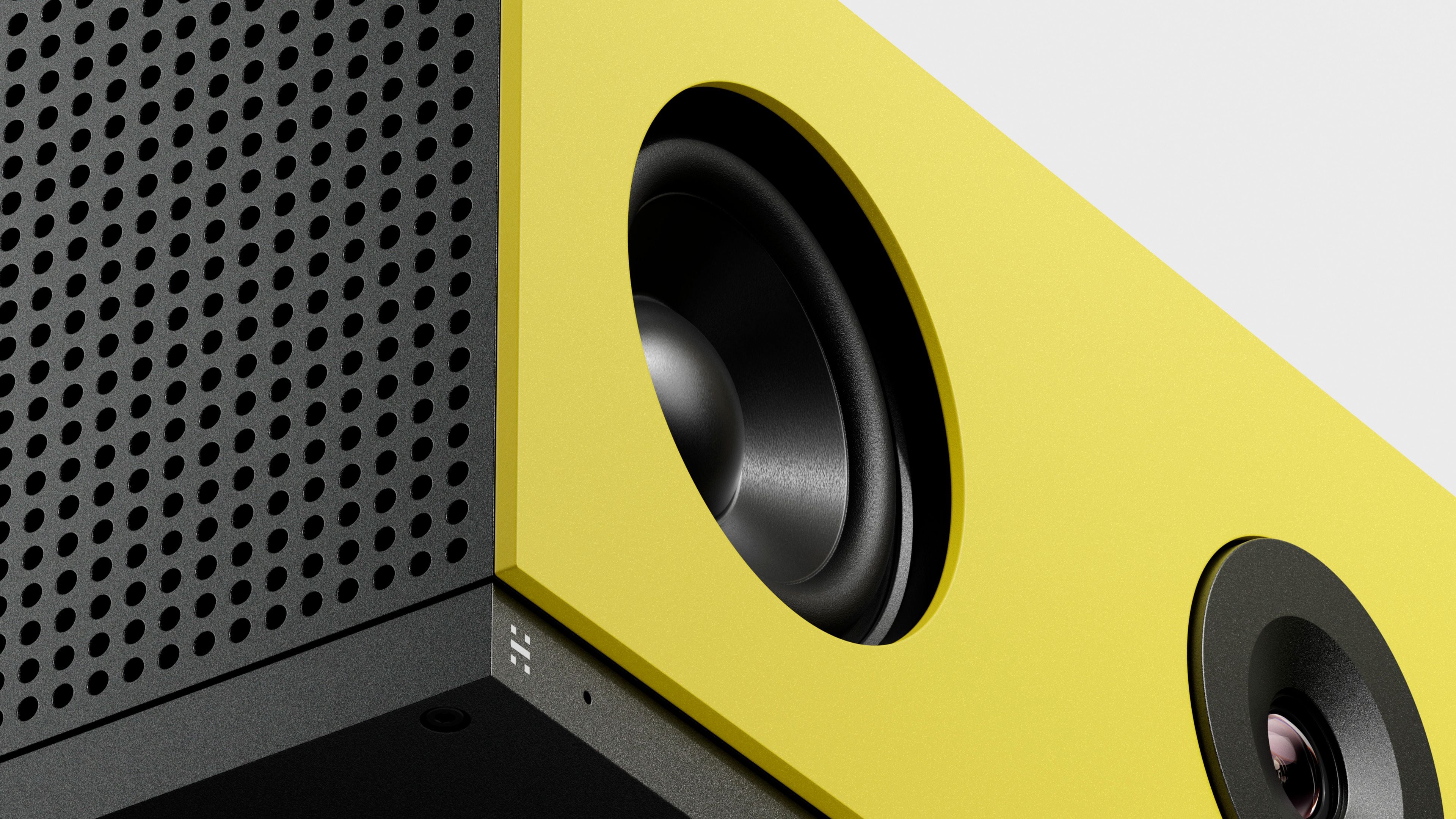

Combining our industry-leading expertise in artificial intelligence, software, hardware, and UX, we craft intelligent camera systems that enable inclusive and productive teamwork.

Huddly cameras are designed to provide high-quality, AI-powered video meetings on major platforms, including Microsoft Teams, Zoom, and Google Meet. With upgradable software, durable hardware, and engaging user experiences, they are the ideal choice for organizations seeking a future-proof, scalable, and sustainable solution.

Founded in 2013, Huddly is headquartered in Oslo, Norway, with presence in the US, EMEA and APAC and global distribution.

Why invest in Huddly?

Stock Exchange Notices

Huddly AS – Notice of extraordinary general meeting

February 25, 2026

Huddly AS – Ex. subsequent offering today

February 25, 2026

Huddly AS – Key information relating to potential subsequent offering

February 24, 2026

Huddly AS – Private placement successfully placed

February 24, 2026

Huddly AS – Contemplated private placement

February 24, 2026

Huddly AS – Q4 2025: 42 % Annual Revenue Increase, Growth Driven by Strategic Partnerships

February 24, 2026

Huddly AS - Financial calendar

February 24, 2026

Financial reports

2025

2024

Huddly Annual Report 2024

Investor Presentation 2024

Financial calendar

Annual Report 2025

Quarterly Report - Q1 2026

Annual General Meeting

Quarterly Report - Q2 2026

Quarterly Report - Q3 2026

Quarterly Report - Q4 2026

Contact us

Investor-related inquiries can be sent to: ir@huddly.com